Understanding Commercial Banks - A Complete Overview

Learn about commercial banks - their services, regulations, importance, trends, and challenges. Get a complete overview of the industry.

A commercial bank is a financial institution that accepts deposits from the public and provides various financial services, such as loans, credit cards, investment products, and other financial services. Commercial banks are profit-oriented institutions that offer services to individuals, businesses, and other organizations. They are regulated by government authorities and play a crucial role in the economy by providing credit to businesses and individuals, supporting economic growth, and contributing to financial stability. Commercial banks differ from investment banks in that they primarily deal with the public and their deposits, while investment banks primarily deal with underwriting and issuing securities.

History of Commercial Bank

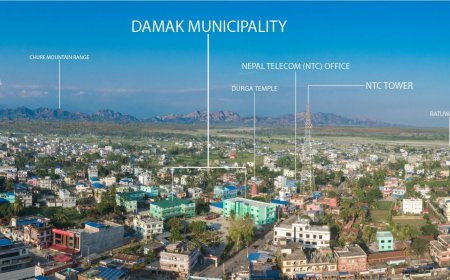

However, the development of the banking sector in Nepal was slow until the 1960s, when the country began to open up to foreign investment and trade. In 1966, the Nepal Rastra Bank, the central bank of Nepal, was established to regulate and supervise the banking system in the country.

In the following years, several other commercial banks were established, including the Rastriya Banijya Bank in 1966, the Nepal Bank of Ceylon in 1975 (which later became the Bank of Ceylon), and the Standard Chartered Bank of Nepal in 1987. The liberalization of the Nepalese economy in the early 1990s led to a rapid expansion of the banking sector, with several new commercial banks being established. Today, over two dozen commercial banks are operating in Nepal, providing a wide range of banking services to individuals and businesses.

Types of Commercial Bank

Commercial banks are financial institutions that provide various banking services to individuals, businesses, and government entities. There are different types of commercial banks, including:

-

Retail or consumer banks:

These are commercial banks that offer a range of banking services to individual customers, such as checking and savings accounts, loans, credit cards, and mortgages. -

Corporate or business banks:

These banks provide banking services to large corporations, small and medium-sized enterprises (SMEs), and other business entities. They offer services such as lending, investment banking, treasury management, and cash management. -

Investment banks:

These banks primarily deal with providing investment services to their clients. They provide securities underwriting, mergers and acquisitions (M&A) advisory, and securities trading. -

Private banks:

These banks provide personalized banking services to high-net-worth individuals (HNIs) and their families. They offer services such as wealth management, investment management, and estate planning. -

Cooperative banks:

These banks are owned and operated by their members, who are typically from a common profession or geographic region. They offer services such as savings and loans, checking accounts, and other banking services. -

Development banks:

These banks focus on providing funding and other support to promote economic development in their countries. They offer services such as financing for infrastructure projects, SMEs, and social enterprises.

These are some of the common types of commercial banks. However, some banks may offer a combination of services and may not fit neatly into a single category.

Services Offered by Commercial Banks

Commercial banks in Nepal offer a wide range of services to their customers. Some of the services offered by commercial banks in Nepal include:

-

Deposit accounts:

Commercial banks in Nepal offer various types of deposit accounts, such as savings accounts, current accounts, fixed deposit accounts, and recurring deposit accounts. Customers can choose the type of account that suits their needs and earn interest on their deposits. -

Loans and credit:

Commercial bank provides loans and credit to their customers for various purposes such as home loans, personal loans, business loans, and education loans. They also offer credit cards and overdraft facilities to their customers. -

Money transfers:

Commercial banks in Nepal offer money transfer services such as wire transfers, electronic fund transfers, and remittances. Customers can transfer money within Nepal or internationally. -

Foreign exchange services:

Commercial banks in Nepal provide foreign exchange services such as currency exchange, travel cards, and foreign currency accounts. Customers can buy or sell foreign currency at the prevailing exchange rate. -

Online banking:

Commercial banks in Nepal provide online banking services to their customers, which allow them to access their accounts, transfer money, pay bills, and check account balances from anywhere. -

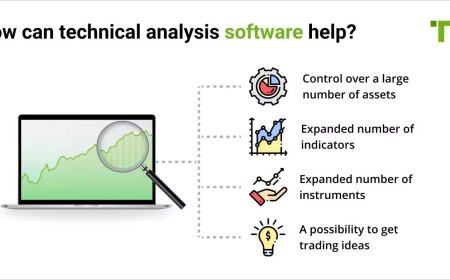

Investment services:

Commercial banks in Nepal provide investment services such as mutual funds, stock trading, and investment advice. Customers can invest in various financial instruments through the bank. -

Insurance services:

Some commercial banks in Nepal also offer insurance services such as life insurance, health insurance, and travel insurance.

These are some of the common services offered by commercial banks in Nepal. However, the services offered may vary from bank to bank.

Importance of Commercial Banks

Commercial banks play a vital role in the economy of a country. Commercial banks are important for a variety of reasons, including:

-

Mobilization of savings:

Commercial banks mobilize savings from individuals and businesses by offering various types of deposit accounts. These savings are then used to provide loans to individuals and businesses for various purposes. -

Credit creation:

Commercial banks create credit by lending out a portion of the deposits they receive. This credit creation helps stimulate economic growth by providing funds to individuals and businesses to invest in various projects and expand their operations. -

Facilitate trade and commerce:

Commercial banks provide various services, such as money transfers, foreign exchange, and trade finance, which facilitate trade and commerce within and outside the country. This, in turn, promotes economic growth and development. -

Provision of loans:

Commercial banks provide loans to individuals and businesses for various purposes, such as home loans, personal loans, business loans, and education loans. This enables individuals and businesses to meet their financial needs and pursue their goals. -

Employment generation:

The provision of credit by commercial banks helps to create employment opportunities in various sectors of the economy. Businesses can expand their operations, leading to increased employment opportunities for people. -

Payment and settlement system:

Commercial banks provide payment and settlement services to individuals and businesses, which facilitate the smooth functioning of the economy. This enables businesses to carry out transactions seamlessly, leading to increased efficiency and productivity. -

Facilitate government operations:

Commercial banks facilitate the operations of the government by providing banking services such as managing government funds, providing loans, and managing foreign exchange reserves.

In summary, commercial banks are important institutions that play a vital role in the economic development of a country. They help mobilize savings, create credit, facilitate trade and commerce, provide loans, generate employment, provide payment and settlement services, and facilitate government operations.

Regulations Governing Commercial Banks

Commercial banks are heavily regulated by various regulatory bodies to ensure their safety and soundness and to protect the interests of depositors and the stability of the financial system. Some of the regulations governing commercial banks include:

-

Licensing:

Commercial banks must obtain a license from the regulatory authority before they can start their operations. The regulatory authority sets certain standards and criteria that banks must meet before they are granted a license. -

Capital requirements:

Commercial banks are required to maintain a certain level of capital to ensure that they have enough funds to absorb potential losses. The regulatory authority sets minimum capital requirements that banks must meet. -

Reserve requirements:

Commercial banks are required to maintain a certain percentage of their deposits as reserves with the central bank. This helps to ensure that banks have enough funds to meet the withdrawal demands of their customers. -

Disclosure requirements:

Commercial banks are required to disclose their financial information to the regulatory authority and the public. This includes information about their assets, liabilities, capital, and operations. Supervision:

Commercial banks are subject to ongoing supervision by the regulatory authority. This includes regular examinations of the bank's financial condition, risk management practices, and compliance with regulations.-

Consumer protection:

Commercial banks are required to comply with consumer protection laws and regulations. These laws and regulations aim to protect the interests of depositors and borrowers by ensuring fair and transparent banking practices. -

Anti-money laundering and counter-terrorism financing:

Commercial banks are required to implement measures to prevent money laundering and the financing of terrorism. This includes implementing customer due diligence measures, reporting suspicious transactions, and complying with sanctions regimes.

In summary, commercial banks are subject to various regulations and supervisory measures to ensure their safety and soundness and to protect the interests of depositors and the stability of the financial system. These regulations cover areas such as licensing, capital requirements, reserve requirements, disclosure requirements, supervision, consumer protection, anti-money laundering, and counter-terrorism financing.

Current Trends and Challenges facing Commercial Banks

-

Increasing competition:

With the entry of new players in the market, commercial banks in Nepal are facing increasing competition. Non-banking financial institutions, payment service providers, and fintech companies are offering innovative services, which is putting pressure on traditional banks to adapt and innovate. -

Digital transformation:

The digital transformation of the banking industry is rapidly changing the way commercial banks operate. The adoption of digital technologies such as mobile banking, online banking, and digital payments is creating new opportunities and challenges for commercial banks in Nepal. -

Risk management:

Commercial banks in Nepal are facing increasing risks, including credit risk, market risk, and operational risk. Banks must have robust risk management systems in place to identify, measure, and manage these risks. -

Capital requirements:

Commercial banks in Nepal are subject to capital requirements set by the regulatory authority. Meeting these requirements can be challenging, especially for smaller banks, and can limit their ability to grow and expand their operations. -

Compliance requirements:

Commercial banks in Nepal are subject to various compliance requirements, including anti-money laundering and counter-terrorism financing regulations. Compliance with these regulations can be time-consuming and costly. -

Financial inclusion:

Despite progress in recent years, a significant portion of the population in Nepal remains unbanked. Commercial banks face the challenge of expanding their reach and providing services to underserved communities. -

Macroeconomic conditions:

Commercial banks in Nepal are affected by the country's macroeconomic conditions, including inflation, exchange rates, and political stability. These factors can impact the profitability and stability of banks.

In summary, commercial banks in Nepal are facing a range of trends and challenges, including increasing competition, digital transformation, risk management, capital requirements, compliance requirements, financial inclusion, and macroeconomic conditions. Addressing these challenges will require banks to innovate, adapt, and implement effective risk management and compliance systems.

What's Your Reaction?