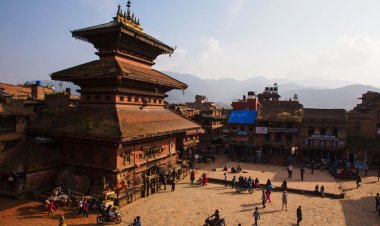

Rapid Increase in Land and House Prices in Nepal

Discover the factors driving Nepal's real estate bubble, the impact of soaring land prices, and potential solutions to regulate the market and address the housing crisis.

Last year, a piece of land in Durbarmarg, a bustling commercial area in Kathmandu city, was sold for a staggering amount of Rs. 90,000,000, equivalent to approximately $750,000. What makes this transaction intriguing is the fact that the price per square meter of that land exceeded $22,000, ranking it among the world's top ten most expensive real estate properties. This trend of exorbitant prices for housing and land is not limited to Kathmandu alone but extends throughout the entire country. As per the Nepal Rastra Bank, the property value in the Kathmandu Valley is experiencing an annual growth rate of 27.7%. This means that the real estate value is doubling approximately every 3.5 years. In contrast, salaries are only increasing by 7.45% annually.

In this article, we will delve into the causes and progression of the ongoing real estate bubble, utilizing various sources to explore the topic comprehensively.

Reasons behind the rise in housing and land prices in Nepal:

The decade-long People's War led by the Maoists primarily took place in rural areas, prompting a significant migration of people from rural to urban regions in search of improved facilities and opportunities. According to a report, over the past 15 years, it has been observed that approximately one out of every three Nepalis has consistently left their hometowns, resulting in a substantial population disparity between villages and cities. These dynamics have created a heightened demand for housing and land in urban areas, subsequently leading to an increase in prices.

During the period of the Maoist-led People's War, there was an upward trend in people seeking opportunities abroad, reincreasing emittance inflows for the country. Over the past 20 years, the amount of remittance has multiplied by 15 times. This situation has created a strong desire among individuals to invest their hard-earned money in owning their own houses and land, further increasing the demand for real estate. Simultaneously, due to a lack of clear government regulations, the supply of housing and land has also increased, contributing to the overall dynamics of supply and demand in the market.

One of the key contributing factors to the emergence of the real estate bubble can be attributed to the relatively low tax imposed on land transactions. It is noteworthy that while most business transactions entail a substantial transaction fee of 25%, the fee associated with housing and land transactions remains remarkably low, standing at a mere 5%. This considerable discrepancy in transaction fees has inadvertently sparked a notable surge in brokerage activities within the real estate market. Consequently, this trend has given rise to a growing prevalence of high broker fees as industry professionals seek to capitalize on the lucrative opportunities presented by the sector.

Between 2007 and 2009, the banks in Nepal witnessed a significant surge in real estate loans, with the total amount increasing from 2 billion to 24 billion Nepali rupees. Notably, the banks extended loans amounting to approximately 160 billion Nepali rupees in the real estate sector during that period. However, it is worth mentioning that only 10% of these loans were provided to the formal real estate sector, while the remaining 90% were directed towards the informal real estate sector.

<h2style="text-align: justify;">Factors behind land price hike:

-

Engaging in agriculture year after year without generating sufficient income, individuals are enticed by the prospect of earning significant money through the subdivision and sale of their land. Unfortunately, this mindset causes people to disregard the agricultural potential of the land, leading to its destruction. People often overlook the distinction between land suitable for agriculture and land suitable for housing. Although the law identifies eight different types of land, the absence of a stringent mechanism results in all lands being developed and sold, ultimately leading to the depletion of arable land.

-

The perception that farmland has a fixed value is challenged when individuals realize that constructing a house on the same land increases its price. Furthermore, if the house serves as a residence, doubles as a school building, and accommodates a business, the land's value skyrockets. This concept directly contributes to the escalation of both land and housing prices.

-

The circulation of rumors significantly contributes to the increase in land prices. As an illustration, approximately 10 to 15 years ago, a rumor emerged suggesting that there were plans to relocate Nepal's capital city from Kathmandu to Chitwan. This led to a surge in land prices in Chitwan, with many individuals rushing to purchase land plots in anticipation of the supposed capital shift.

Effects of soaring prices:

-

Agricultural land loss:

Converting farmland into developments for profit can be harmful. Loss of arable land could disrupt food security. Fertile land conversion compromises food production, leaving communities vulnerable to shortages and price fluctuations. Urbanization and development reduce farmland, hurting rural incomes and worsening poverty. Land conversion can harm water resources, air quality, and ecosystems beyond the local area. -

Affordability and Homeownership:

High housing and land costs impact people's ability to find stable homes. No access to housing leads to poor living conditions or homelessness. This harms people's well-being, stability, and quality of life, eroding their sense of security and belonging. The drop in homeownership affects the housing market. Less demand for homeownership increases rental property surpluses and competition, which may raise rental prices. -

Housing Crisis:

High housing prices worsen the urban housing crisis where demand exceeds supply. This situation has caused overcrowding, poor housing, and informal settlements. High housing costs create barriers for people seeking affordable and secure homes, worsening socio-economic disparities. Addressing the housing crisis is critical, requiring strategies to expand affordable housing, improve living conditions, and reduce informal settlements. -

Inequality:

Rising property values worsen wealth inequality. As property values rise, real estate owners benefit, gaining wealth through price appreciation. Those unable to afford property face obstacles to accumulating wealth. Unequal property ownership reinforces wealth gaps, hindering financial mobility for those unable to enter the real estate market. -

Economic Impact:

High housing and land prices distort the economy. Real estate dominance can hinder economic development by diverting resources from other sectors. Overinflated real estate leads to resource misallocation. High housing costs might push investors and entrepreneurs towards real estate, taking resources from other vital sectors. Unequal resource allocation hinders growth in manufacturing, technology, and services. Thus, the economy relies heavily on real estate, making it more susceptible to market changes and downturns.

A Possible Solution to Control the Prices:

Four years ago, the budget unveiled a crucial announcement mandating the compulsory registration of individuals engaged in real estate activities. However, despite the passage of time, the implementation of this decision is still pending. The delayed enforcement of this registration requirement has hindered its potential impact on the real estate market. Nonetheless, if and when this decision is effectively activated, it holds the potential to exert control over land prices to a certain extent. Consequently, the activation of this decision has the potential to foster a more regulated and stable real estate market, benefiting both buyers and sellers alike.

The economic crisis of 2008 had significant ties to the housing bubble, highlighting the need for measures to control and prevent such occurrences. In response, the government should recognize the importance of mitigating the risks associated with the housing market and should implement various measures to address the issue. One such measure involved increasing the profit tax levied on land transactions by 5 percent. By raising the tax rate, the government aimed to discourage speculative activities and curb excessive price inflation in the real estate sector.

The increase in land value can be attributed to its versatile usage. If the government restricts the utilization of land to specific purposes, such as agricultural activities, the cost of land remains steady.

An alternative approach involves implementing stricter control and regulation over how banks extend credit to individuals. It is imperative to establish guidelines that prohibit banks from granting loans when land with inflated values is presented as collateral. By enforcing such regulations, the government can mitigate the potential risks associated with inflated land prices and speculative lending practices. Former Finance Minister Surendra Pandey says, If banks stopped lending based on land put up as collateral, the price of land would go down automatically.

What's Your Reaction?