20 Learnings from The Richest Man in Babylon

The Richest Man in Babylon is a book that teaches the importance of saving and investing for the future and that provides practical tips and strategies for building financial wealth.

"The Richest Man in Babylon" is a book written by George S. Clason that offers financial advice through a series of parables set in ancient Babylon. The book's central theme is the importance of saving and investing for the future, and it provides practical tips and strategies for building wealth and financial security.

- Saving at least 10% of your income is crucial for financial stability and success.

- Investing in profitable ventures, such as owning a business or real estate, can lead to financial growth.

- It's important to have a clear financial goal in mind, such as saving for retirement or purchasing a home, and to create a plan to achieve it.

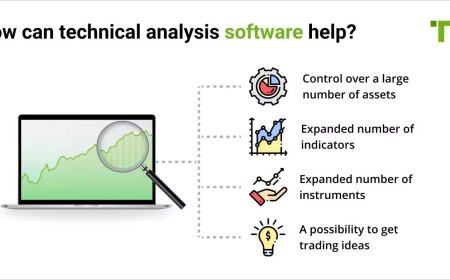

- Diversifying your investments can reduce risk and increase the chances of financial success.

- Paying off debt should be a priority, as it can reduce financial stress and increase your ability to save and invest.

- It's important to continually educate yourself about personal finance and investing in order to make informed decisions.

- Seeking the advice of financially successful individuals can be helpful in making sound financial decisions.

- It's important to have discipline in your spending and to avoid unnecessary expenses.

- Building a strong foundation of savings and investments can provide financial security and stability.

- It's important to have a plan for handling unexpected expenses, such as creating an emergency fund.

- Setting aside money for short-term and long-term goals can help to ensure financial success.

- It's important to live within your means and not to overspend or take on too much debt.

- Building a strong network of supportive and financially successful individuals can provide valuable guidance and opportunities.

- It's important to be proactive in managing your finances and not to procrastinate or avoid addressing financial issues.

- Having a clear understanding of your financial situation and making informed decisions can help to increase your wealth.

- It's important to have a sense of financial responsibility and to be accountable for your financial actions.

- Developing good financial habits, such as saving and budgeting, can help to ensure long-term financial success.

- It's important to have a sense of financial independence and to not rely on others for financial support.

- Having a financial plan and sticking to it can help to achieve financial stability and success.

- It's important to be patient and consistent in building wealth, as it is a long-term process that requires discipline and perseverance.

In conclusion, "The Richest Man in Babylon" offers a wealth of practical and wise advice for achieving financial success. By saving a portion of your income, investing wisely, living within your means, and developing good financial habits, you can increase your wealth and achieve financial stability and security. It's important to have a clear financial goal in mind, create a plan to achieve it, and seek the advice of financially successful individuals. Financial success requires discipline, patience, and consistency, and by following the principles outlined in this book, you can set yourself on the path to achieving your financial goals.

What's Your Reaction?