Mobile Banking in Nepal - A Guide to Digital Transactions and Services

Learn about mobile banking in Nepal and how it is changing the way people conduct financial transactions. Get an in-depth look at the technology and services that are making banking more convenient and accessible.

Nepal Bank Limited established in 1937 A.D was the first commercial bank in Nepal to provide financial services to the people. It was started by King Tribhuvan Bir Bikram Shah Dev on 13 March 1994 B.S. This contribution is considered to be a milestone in the history of Nepali banks. It is made up of a partnership between government and the general public with a certified capital of NPR 10 million and a paid capital of NPR 892 thousand. Until 1940 A.D. the financial system was based on coins. Nepal Bank Limited remained as the sole financial institution until 1956 A.D. when Nepal Rastriya Bank, also known as Nepal's largest bank these days was established. Nepal Rastriya Bank develops strategies for the Nepal banking sector.

In order to preserve the country's economic development, the Industrial Development Bank which was transformed into the Nepal Industrial Development Corporation (NIDC) in 1959 A.D. was established in 1957 A.D. The main purpose of the establishment of the bank was to promote industrialization in the country. After the establishment of the first commercial bank, the same bank called Rastriya Banijya Bank which is the largest commercial bank in Nepal today was established in 1966. Agriculture is a big business as more than 70% of the people depend on it. In order to maintain economic equality and prosper the agricultural sector, the First Agricultural Development Bank was established in 1968. After the establishment of joint venture banks in 1984, the rise of the national government bank ended.

Current Status

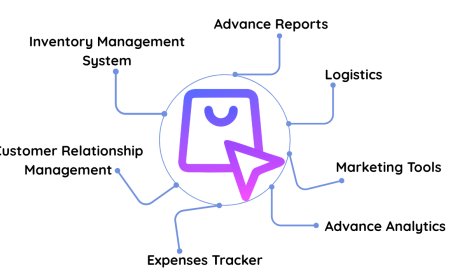

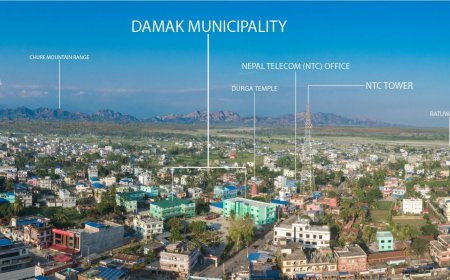

With the development of new technologies in the country, the banking sector and its services have been completely transformed. Today the banking sector is more organized, modern and manageable than twenty years ago. Various banking services such as Banking software, ATM, Internet Banking, Mobile Banking, Debit Card, Credit Card, Prepaid Card etc. services are available at Nepalese bank these days. There are various types of banks operating in the current Nepal banking system. They are central banks, development, commercial, financial, cooperatives and Micro Credit (Grameen) banks. Currently there are 1 central, 30 commercial, 78 Development, 37 microfinance banks and 49 financial companies in Nepal. Nepal Bank Limited is also Nepal's first commercial bank with the largest network in the banking sector. Comparing Nepal's modern banking system with the conventional banking system, the modern banking system has begun to establish more branches across the country.

With established branches, life of Nepalese in the sense of financial services has become easier than ever. Currently, most commercial banks entering the ‘A’ category have started mobile banking services. Although commercial banks have started mobile banking services to improve Nepal's banking system, the popularity of mobile banking is slowly growing in the country.

CHALLENGES OF MOBILE BANKING IN NEPAL

Nepal is a country where technology is growing at a slower pace. Compared to developed countries, Nepal is still a long way off in terms of technology. Despite having technologically acceptable technologies in urban areas, in contrast, in rural areas people are reduced to using new technological resources. As mentioned earlier that more than 70% of Nepalese people have banks, so there is a huge challenge to the acceptance of mobile banks in Nepal. People living in the capital are more educated than people living in rural areas. Here are some of the factors that may be a challenge for mobile banking in Nepal.

1. Infrastructure Development

- The development of any country can be easily seen through the development of infrastructure. In Nepal, infrastructure development is grim. The situation is difficult even in rural areas where people are deprived of many resources. Because of the traditional system in the minds of Nepalese people, they keep themselves away from new technological services. In order to have smooth portable banking services, communication channels should be fast enough to respond on time. Nepal's level of literacy is below the threshold that creates a direct impact on the use of new technological services, here in our case of mobile banking.

2. Attitude towards Banks

- Due to a lack of awareness among Nepalese people, mobile banking is not growing at the expected rate. Although various commercial banks in Nepal have introduced mobile banking services to their customers, people are still relying on the old banking tradition. Most people, especially in rural areas, sell cash instead of going to the banks. This results in lower utilization of mobile banking services. Most educated people are in urban areas and mobile banking seems to be very popular with young people. Although mobile phone users are growing rapidly in Nepal but they have no idea about the use of a mobile banking which is one of the easiest ways of banking services.

3. Trust In Mobile Banking

- For any type of technical services, security is one of the biggest issue. Here in the case of mobile banking, security should be a high priority. Nepal's technology base is not as strong as expected. Compared to developed countries, the security system for technical services in Nepal needs to be significantly improved. Every year different software developer company in Nepal tries to apply different security measures to mobile banking services but still it lacks high level security.

4. Language Features

- Nepal is a country where there are 4 castes and 36 subcastes. There are many Nepali people who can speak and write Nepali but no other languages. There are also many public schools / colleges where most of the courses are offered in the local language, i.e. Nepali which leads to poor understanding of other languages i.e. English language. As Nepal's mobile banking app operates in English, there is a need to develop a mobile banking in a local language. The development of mobile banking in the Nepali language will not only make life easier for Nepali but at the same time it helps to increase the popularity of mobile banks in Nepal.

5. Handset operation

- Even mobile phone users are growing every year in Nepal but in the case of mobile banking it depends on what type of mobile phone you have. In the case of an SMS alert banking, it may support normal mobile phones but in the case of a mobile banking client application then the platform is different. Apart from the platform, there can be issue with operating system, system requirements in mobile phones. The client-based mobile app is particularly well suited to the current version of smartphones which is the latest mobile technology. But when it comes to Nepal where poverty is estimated at 40% ,

Types of Mobile Banking Architecture

There are 3 types of facilities for mobile banking services. They are described below-

1. SMS OR MMS-BASED MOBILE BANKING:

SMS (Short Message Service) was the first mobile banking service available when mobile banking became available. The connection is based on a blank text. There are two ways to bank SMS. They are a pull and push mode. Pull mode is one way of sending messages where the financial institution sends messages to the user about his or her account status. This method can be used to promote other mobile banking services where the push method is a two-way messaging system where the user sends a specific request about his transaction to the bank with the help of the pre-defined code and the bank replies it in the form of text messages.

Basically, there are 2 types of messaging systems. SMS and MMS (Multimedia Messaging System). SMS banking handles only small messages which are limited while on the other hand MMS can handle large messages but has the same functionality as SMS. To use this type of MMS mobile banking, the user must register his mobile device with the bank and the bank sends text messages with the required password acting as a mobile bank activation code. The great advantage of using SMS-based mobile banking is that it is an inexpensive and standard technology service, and is available on almost all mobile phones regardless of manufacturer, model number or network company. It has a habit of providing both communication between the bank and the user. As for security features which is one of the major factors to keep in mind, it does not transmit or store users' personal information on a mobile device.

2. WEBSITE-BASED MOBILE BANKING

- Another type of mobile banking based on the architecture is browser-based mobile banking. This type of banking service can be accessed from an Internet browser on a mobile device. This service is available on the banking website on mobile devices provided by the relevant financial institutions. The user can connect to a mobile banking website either via WAP (Wireless Access Protocol) or through some other Internet services provided by ISPs. Wireless Access Protocol, founded in 1990, enabled mobile devices to access the Internet. It is an industry standard for gaining access to information through a wireless mobile network. This type of banking service is easy to use and easily accessible even when network quality is acceptable. The great advantage after using this type of service is that most of the data management is done on a remote server which helps to quickly process user interaction with banking websites. This type of banking service has certain limitations as well. In order to provide banking services to mobile devices, a designed website should also be responsive for mobile screens. A user who uses Internet services with a data plan on mobile devices, this may incur additional costs as the user must gain access to the banking website. This type of banking service these days, is mainly designed for smartphones and other Personal Digital Assistant (PDA).

3. CLIENT-BASED MOBILE BANKING

- With the development of smartphones, technology in terms of mobile phones has reached a new era. With smartphones, one can feel the presence of personal computers in hand. Customer-based mobile banking is ideal for smartphones and other PDAs that tendency to run an application provided by concerned banks. This type of banking service requires download and install of respective banking application. This is also one of the easiest means of banking services.

With the help of a bank application that works on smartphones, the user can have one touch access to various bank account services. This type of application-based banking services have the same features as web-based banking services. The main drawback of using this banking service is that users have to learn about this new app and at the same time it is not supported on all types of mobile devices due to technical limitations on mobile devices. As mentioned above on web-based mobile banking, this type of banking services can also be costly for those users who have a data plan for internet connection.

Conclusion

The number of mobile banking users is growing every year at various rates especially in urban areas where technology is advancing rapidly. The technology has replaced Nepal's traditional banking system into a modern banking system with a variety of services such as ATMs, online banking, mobile banking. As mobile banking is not fully accessible in rural Nepal but various projects and efforts are being made by many organizations to improve information on mobile banking .However, the current situation shows that more than 70% of Nepali households are unbanked but it can be expected that with the initiation of mobile banking in different parts of Nepal will help those unbanked households to get an idea about normal banking systems. It can also be expected that with mobile banks, there will be a major shift in payment systems in Nepal which will make the lives of Nepali people easier and more economically viable.

What's Your Reaction?