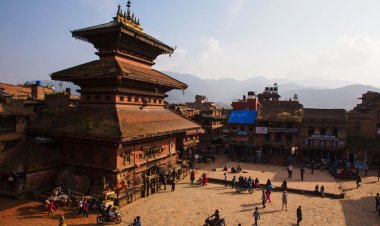

Financial Status of Nepali Citizens: Challenges and Opportunities

Explore the financial status of Nepali citizens and the challenges and opportunities for promoting financial inclusion and economic growth.

Nepal has made significant progress in recent years in terms of financial inclusion and increasing access to financial services for its citizens. Despite this progress, there are still significant challenges that need to be addressed to improve the financial status of Nepali citizens.

Registered Saving Account Penetration in Nepal

One of the key indicators of financial inclusion in Nepal is the registered saving account penetration rate. Registered savings account penetration in Nepal is 143% as of 2079 / 2080.This means that there are more registered saving accounts in the country than the total population.

Population with a Registered Savings Account per Local Body Type

While the overall registered savings account penetration rate in Nepal is high, there are significant disparities in the access to financial services based on the type of local body. According to the Key Financial Inclusion Indicators of NRB, the registered saving account penetration rates per local body type are as follows:

- Metropolitical City: 480%

- Sub-Metropolitan City: 234%

- Municipality: 134%

- Rural Municipality: 52%

This data indicates that citizens living in urban areas have better access to financial services compared to those living in rural areas.

Men and Women with an Active Saving Account

Another important aspect of financial inclusion is the gender gap in access to financial services. As of 2079/2080, 49% of men and 46% of women in Nepal have an active saving account. This indicates that there is still a significant gender gap in financial inclusion in the country.

Population without Access Point in Local Body

Despite the progress made in increasing access to financial services, there are still areas where citizens do not have access to an access point within their local body. As of 2079/2080, there are approximately 2.20k citizens in Nepal without access to an access point in their local body.

Challenges and Opportunities

The challenges facing the financial status of Nepali citizens are:

- Limited access to financial services, particularly in rural areas.

- Low financial literacy, which can limit the ability of citizens to effectively manage their finances and access financial services.

- Gender gap in financial inclusion, with women having lower access to financial services than men.

- Lack of infrastructure, such as roads and electricity, in rural areas that can hinder the delivery of financial services.

- Limited availability of credit, which can make it difficult for citizens to start or grow businesses.

- Insufficient government support for financial inclusion initiatives.

Also some opportunities are:

- Rapid adoption of mobile technology, which can increase access to financial services, particularly in rural areas.

- Increasing number of banking agents and mobile money operators, which can expand the reach of financial services.

- Growing awareness of the importance of financial inclusion and financial literacy, which can help to drive demand for financial services.

- Availability of government funding and grants for financial inclusion initiatives

- Increasing availability of credit through government and private sector initiatives

- Potential for tourism and remittances to drive economic growth and increase demand for financial services.

The Path Forward

Some of the points on the path forward for improving the financial status of Nepali citizens are:

-

Increasing Access to Financial Services:

The government and private sector need to work together to increase access to financial services, particularly in rural areas. This can be achieved through policies and programs that promote digital financial services and mobile banking, as well as the establishment of more banking agents and mobile money operators in underserved areas. -

Improving Financial Literacy:

Financial literacy programs can help citizens to better manage their finances, understand financial products and services, and make informed financial decisions. Such programs can be delivered through schools, community centers, and other channels. -

Addressing the Gender Gap:

The government and private sector need to work together to address the gender gap in financial inclusion. This can be achieved through policies and programs that promote financial inclusion for women, such as gender-sensitive financial products, women-only savings groups, and targeted financial literacy programs. -

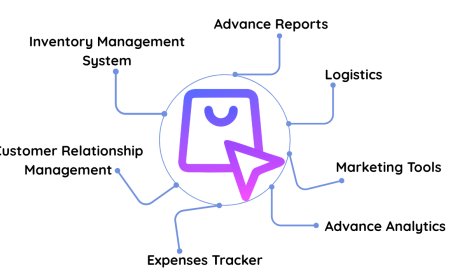

Leveraging Technology:

The rapid adoption of mobile technology offers an opportunity to increase access to financial services, particularly in rural areas. The government and private sector can leverage this technology to develop innovative financial products and services, such as mobile banking and e-wallets, that can be delivered via mobile devices. -

Strengthening Infrastructure:

The government needs to invest in infrastructure, such as roads and electricity, in rural areas to facilitate the delivery of financial services. -

Increasing Availability of Credit:

The government and private sector need to work together to increase the availability of credit for citizens, particularly for small and medium-sized enterprises. This can be achieved through government-backed lending programs and the development of innovative financial products, such as peer-to-peer lending platforms. -

Promoting Financial Inclusion:

The government and private sector need to promote financial inclusion through policies and programs that address the needs of underserved communities, such as low-income households, rural populations, and women.

In conclusion, the financial status of Nepali citizens has improved significantly in recent years, with a high registered savings account penetration rate and the adoption of digital financial services. However, there are still significant challenges that need to be addressed to improve financial inclusion, particularly in rural areas and for women.

The government, private sector, and civil society organizations need to work together to increase access to financial services, improve financial literacy, and address the gender gap in financial inclusion. This can be achieved through policies and programs that promote digital financial services and mobile banking, particularly in rural areas.

Nepal has made progress in improving the financial status of its citizens, but there is still a long way to go. By addressing these challenges and leveraging opportunities, Nepal can further improve the financial status of its citizens and promote inclusive economic growth.

What's Your Reaction?