Investing in the Stock Market is better than Investing in Real Estate

Advantages of investing in stock market.

Investment of money in different sectors is the primary way to adjust yourself to today's rapid inflation. Making a good investment has always been a hard topic for people. Nowadays, many people find real estate and the stock market to be good investments. But many people have always been in doubt while finding a good source to invest in. In this article we will tell you some of the advantages of investing in the stock market or some of the disadvantages of real estate so that you can decide which is a good investment for you.

Transaction Cost

The trading cost or transaction cost of the stock market is comparatively much lower than the real estate. The charge of a stock market broker is much lower than that of a real estate broker. In real estate, the broker charges around 2-3% of total investment and also 4.5% for ownership transfer, whereas in the stock market, the broker charges around 0.25%-0.4% along with Rs 25 for demat charge, which is comparatively much lower than the real estate market.

Amount of Investment

The initial amount to invest in the share market is just Rs. 1000 in IPO/FPO. But the starting price of real estate starts at Rs 500000, which is much higher compared to the stock market. Investing in the stock market can be applicable to any type of person due to its initial starting cost.

Ease in trading

Investing in the stock market is relatively easy compared to the real estate market because in the stock market, people can easily sell or buy stocks just by using their own mobile device or by giving a call to the broker. Unlike in real estate, it takes around 50 to 60 working days to buy or sell.

Liquidity

The stock market is more liquid than the real estate market. People can easily buy the stocks, transfer the ownership, and be ready to invest again in 5 days. Stocks can be easily converted into cash. So, in the case of an emergency, investing in the stock market can be a good option.

Diversification

In the stock market, investors can bear a minimum risk during the downfall of the economy because the stock market has the choice to invest in different companies through which investors can bear a minimum loss while the economy of a certain sector is down. But in real state, investors have to invest a high amount in one place, which can result in a great loss during the downfall of the market.

Annual Income

When it comes to long-term investing, annual income is critical. In the stock market, dividends are distributed by companies annually to their share holders. The dividend can be a case dividend, a share dividend, or both. In the case of real estate, mainly land, there is no way to get an annual income unless the land is given in rent.

Transparency

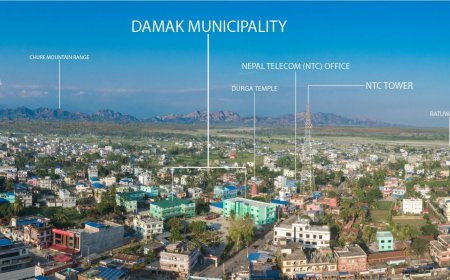

The stock market is much more transparent compared to real estate because all the stocks are listed on the Nepal Stock Exchange (NEPSE). Brokers are strongly regulated by the Security Board of Nepal (SEBON). The price of each share is changed according to the demand and supply in the market. In the case of real estate, there are no strong rules set by the government. People are themselves creating the hike in the market. The prices of real estate are set by brokers without following the rules.

What's Your Reaction?